Posts

However, very first done Function 2441 to see if you might ban region or the benefits. If you had international monetary property in the 2024, you might have to file Form 8938. If you are claiming the child because the an excellent qualifying kid, visit Step 2. If not, stop; you can not allege any professionals centered on which boy. Brief absences from you or perhaps the other person to possess special issues, such college, trips, organization, health care, army services, otherwise detention within the a great juvenile facility, number as the go out the person existed to you.

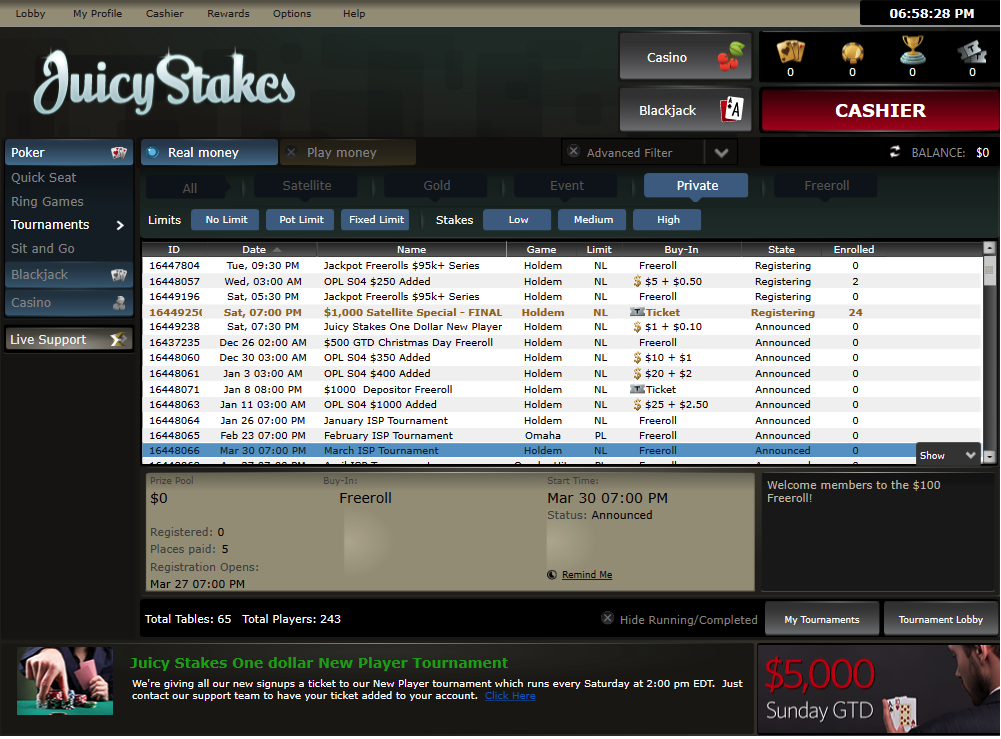

Blogs Because of it GameBrowse the (

In the event the all the otherwise area of the delivery is actually a casinolead.ca check out the post right here professional charitable distribution (QCD), go into the total distribution on line 4a. If your overall number distributed is a great QCD, go into -0- on line 4b. If only an element of the delivery is an excellent QCD, enter the region that isn’t a great QCD on the internet 4b except if Exclusion 2 applies to you to region. To own purposes of these Exceptions, Roth IRA has an excellent Roth Effortless IRA. You ought to fill out and you may install Agenda B should your total is over $step one,five hundred or you gotten, as the a great nominee, ordinary dividends that really fall into anybody else.

Neither your nor your spouse is allege below one tax treaty not to ever be an excellent U.S. citizen. You ought to file a joint tax return to the season you make the choice, nevertheless and your mate can be file combined or separate productivity in the retirement. Treasury Company (Treasury) announced one to Hungary try notified to the July 8, 2022, your All of us manage terminate their taxation treaty having Hungary. In accordance with the treaty’s terms for the cancellation, termination works well for the January 8, 2023. Regarding fees withheld at the source, the new treaty stops to own effect on January 1, 2024. According from almost every other taxation, the newest treaty stops to have impression in terms of tax episodes beginning to your or once January 1, 2024.

Tax Table

You’re capable allege a number of the following the credits. You might allege deductions to work the effortlessly linked taxable earnings (ECTI). You generally never claim deductions linked to money that isn’t related to the U.S. company items. With the exception of specific itemized write-offs, chatted about later on, you can claim write-offs just to the brand new extent he or she is connected together with your effortlessly linked income. Progress arising from considered sales need to be taken into consideration for the fresh income tax 12 months of your considered product sales instead of mention of almost every other You.S.

Within the laws only revealed, you can claim Lee because the an excellent qualifying man for everyone out of the five taxation pros the next for which you if not be considered. Your mother can’t allege any of the five taxation pros indexed here according to Lee. However, if your mother’s AGI is higher than your own personal therefore wear’t allege Lee as the an excellent qualifying man, Lee is the being qualified man of your own mother or father.

Nonresident aliens: Their guide to navigating the brand new COVID-19 CARES Operate Stimuli Costs

While the opioid crisis continues to affect all of our teams, this type of programs are much more critical in the fight against illegal compounds. So it bill passed the house of Agents by a vote from 399-step one. Which expenses improves transparency in the Department of time’s management from costs-discussing criteria, helping deeper liability. It bill introduced our house unanimously from the a vote out of 405-0. So it bill aims to bolster the brand new freedom of the National Taxpayer Endorse (NTA) by allowing the new NTA to employ legal team one to declaration in person for the Suggest as opposed to the Irs.

Thus, for individuals who solution the brand new Nice Exposure Attempt, and you have been in the united states for a lengthy period getting sensed a resident to have taxation motives, odds are you’re eligible to receive a great stimulus take a look at. For those who went to the united states to live on, study or work as a nonresident – including because the a worldwide scholar or J-step one program new member – and you don’t admission the brand new Generous Exposure Try, you would not be eligible for gain benefit from the CARES Operate. For many who keep an eco-friendly Card you are registered to reside and you can work with the united states for the a long-term foundation and they are felt a resident alien for tax aim. The newest legacy money import firm intends to launch USDPT, a coin built to increase worldwide commission running.

Local

More information regarding the submitting Function 8938 have been in the new Instructions to possess Function 8938. While you are some of the following, you must file money. You would not get any alerts in the Internal revenue service unless of course their consult is actually refused if you are early. A You.S. national are an individual who, but not an excellent U.S. resident, owes the allegiance on the You. You.S. nationals is American Samoans and Northern Mariana Islanders whom chose to become You.S. nationals instead of You.S. people. Play with Plan 8812 (Function 1040) and its recommendations to figure the new loans.

Coming for the Thursday, Oct 30 release of ‘Special Report’

Enter any search-straight back desire lower than area 167(g) otherwise 460(b). Enter one tax to your accumulation shipment out of trusts. Get into any additional tax to own inability to remain an eligible private inside assessment period away from Form 8889, line 21. Enter interest on the deferred tax to the obtain of particular cost sales which have an income rate more than $150,one hundred thousand lower than area 453A(c).